Cupertino Home Values 2026: What 2025 Data Reveals for Sellers in the Under $3M, $3M–$4M, and $4M+ Markets

Cupertino’s 2025 housing market finished the year with modest price growth, very low inventory, and strong demand, setting up 2026 for continued price stability to moderate appreciation across all three price bands you care about.

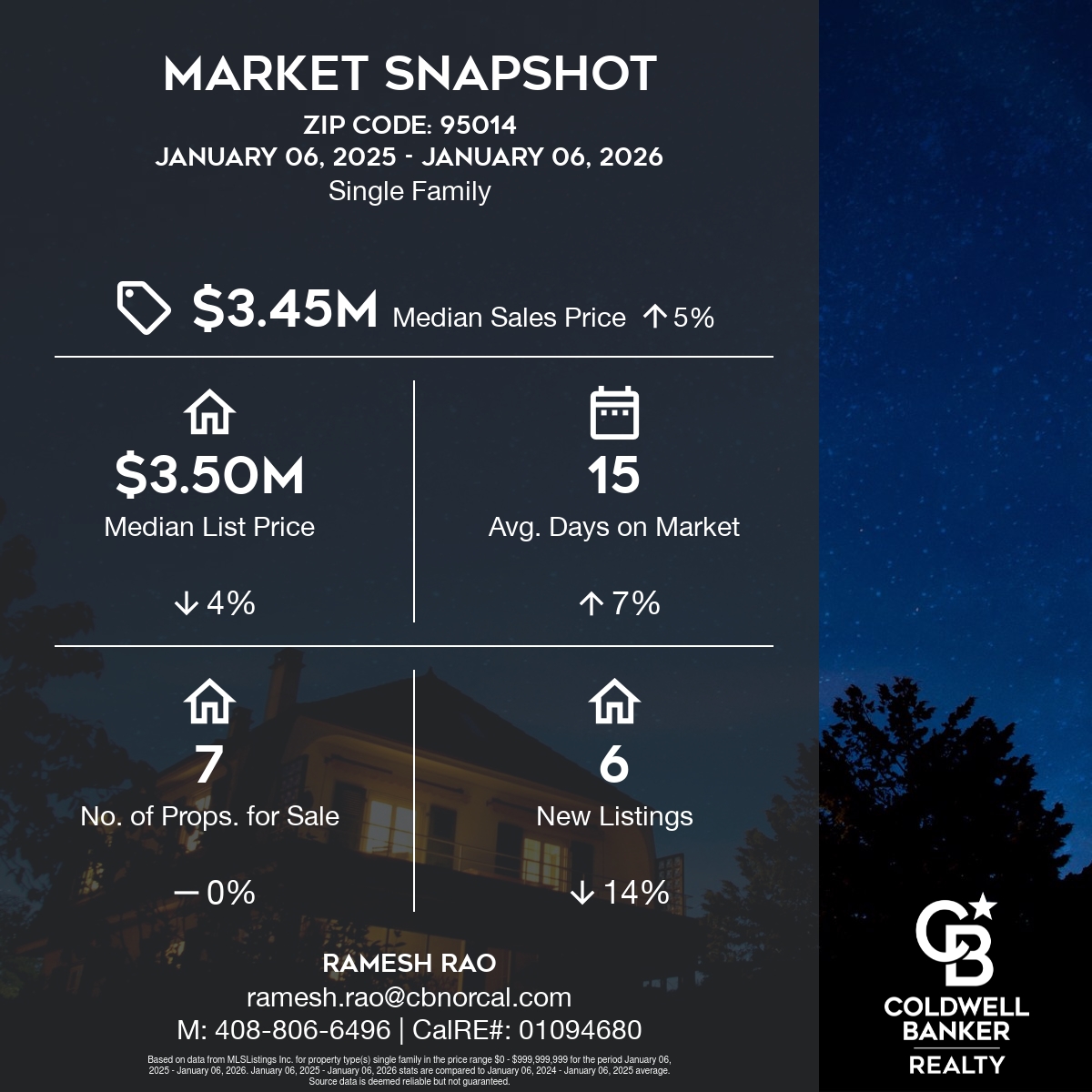

2025 Cupertino market in a nutshell

- The typical Cupertino home value hovered just under the $3M mark in 2025, rising about 1–2% year over year, a “slow but solid” market instead of the breakneck gains seen in pandemic years.

- Median sale prices for single‑family homes tracked in the low‑to‑mid $3M range, with many properties selling above list price and in under a month, reflecting persistent demand and constrained supply.

- Price per square foot remained elevated around the mid‑$1,000s, reinforcing Cupertino’s position as one of Silicon Valley’s most premium school‑driven markets.

How sub‑$3M homes performed

Homes under $3M acted as the “entry ticket” to Cupertino in 2025, especially for tech buyers and families stretching to get into top schools.

- Competition: Sub‑$3M listings often saw multiple offers, as this segment overlaps with townhomes, smaller single‑family homes, and homes needing cosmetic updates, all drawing first‑time and move‑up buyers.

- Pricing and velocity: With the overall median and “typical home value” sitting near the $2.5–$3M band, well‑priced homes here tend to move quickly and, in many cases, sell at or above asking, supported by limited inventory.

2026 outlook (under $3M):

- Expect continued strong demand from buyers prioritizing schools and commute, with modest price appreciation in the low‑to‑mid single digits if inventory stays tight.

- Move‑in‑ready homes and properties walkable to top‑rated schools should command a noticeable premium over dated or compromised locations in this band.

The $3M–$4M “true Cupertino family home” band

The $3M–$4M range behaved as the core family segment in 2025, aligning with many 4‑bedroom Cupertino single‑family homes close to top schools and major employers.

- Pricing: Median single‑family prices in key late‑2025 snapshots sat in the low‑to‑mid $3.3Mrange, indicating that a large share of family homes traded squarely in this band.

- Activity: Days on market stayed low and sale‑to‑list ratios remained strong, confirming that properly prepared and correctly priced homes still attracted multiple qualified buyers despite higher rates.

2026 outlook ($3M–$4M):

- Expect this band to remain the “sweet spot” for Cupertino families, with buyers prioritizing school districts, lot quality, and proximity to Apple Park and other tech campuses.

- If mortgage rates ease or even stabilize, this price band is well‑positioned for steady demand and potential mid‑single‑digit price gains, particularly for updated, turnkey homes.

$4M+ luxury and executive segment

The $4M+ tier is where scarcity and lifestyle really matter—larger lots, newer construction, view homes, and premium school locations.

- Volume and selectivity: Transaction counts at this level were thinner in 2025, but high‑quality properties still achieved strong prices as affluent buyers remained active and less rate‑sensitive.

- Price behavior: With the citywide average and median clustered below $4M, this band behaved more like a luxury niche, where homes either sold quickly when they nailed condition and presentation or sat until pricing aligned with buyer expectations.

2026 outlook ($4M+):

- Expect a very selective but capable buyer pool: executives, founders, and long‑term planners who value Cupertino’s schools and proximity to major tech campuses.

- The best‑in‑class homes (newer builds, remodeled properties on premium lots) are positioned to outperform the broader market, while dated or functionally challenged homes over $4M may need strategic pricing and targeted marketing to move.

What this means for Cupertino buyers and sellers in 2026

For buyers in Cupertino in 2026:

- Under $3M: Focus on school boundaries, structural soundness, and potential to add value through updates; competition will remain strongest here.

- $3M–$4M: Lean on detailed neighborhood and micro‑market guidance to understand why two similar‑looking homes can differ by hundreds of thousands of dollars.

- $4M+: Treat each property as its own micro‑market; negotiation and timing matter more than broad averages at this level.

For sellers planning a 2026 move:

- Pricing precisely within your band—rather than simply “above” or “below” a round number—is essential in a data‑driven market where buyers watch micro‑trends and value per square foot carefully.

- Presentation, preparation, and strategic launch timing can be the difference between multiple offers over asking and a price reduction, especially in the $3M+ brackets, where buyers have high expectations.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link